Risk Is Predictable

Why focus on risk instead of market “price action” or other measures?

Because risk, when modeled correctly, has a much stronger predictability than other measures. The charts below are illustrative of this point. The chart on the left shows that this month’s return on the S&P 500 provides very little predictive value for next month’s return. On the other hand, the chart on the right shows that this month’s volatility of the S&P 500 provides strong predictive value for next month’s volatility.

What is Risk Timing™?

VS Asset’s proprietary Risk Timing™ system makes this predictive capability actionable. The methodology seeks to capitalize on broad market trends, both long-term and short-term, while exploiting the inherent long market bias. Risk Timing™ uses a variety of market, technical and economic indicators to determine the current risk scenario and the corresponding optimal market exposure.

The expected result is substantially higher returns at lower overall risk.

How does Risk Timing™ work?

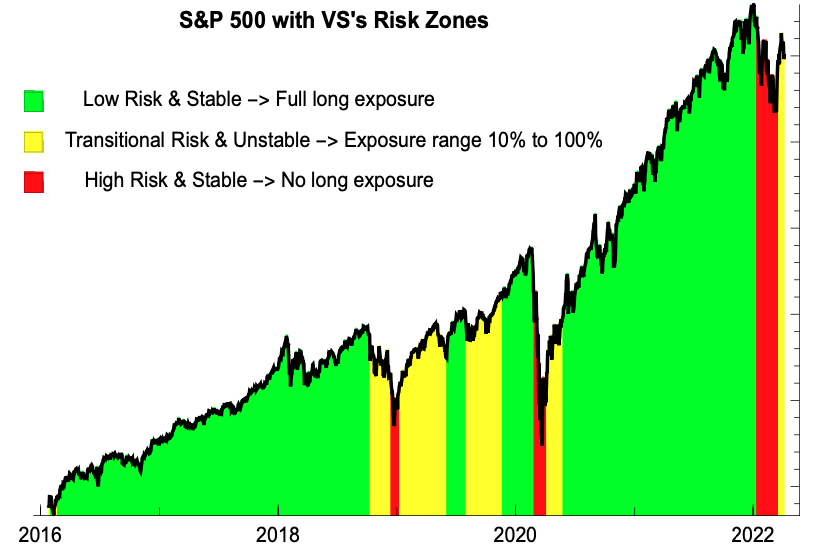

Risk Timing™ works by identifying multiple types of risk and adjusting exposure accordingly. The chart below shows Risk Timing™ recommended exposures overlaid on a chart of the S&P 500 over the last six years.

During stable low risk periods, a portfolio would be at maximal long exposure and will trade minimally. Volatility during a low risk stable period should not equate to risk for most investors. During the unstable transitional risk periods, a portfolio would have its long exposure actively scaled up and down based on the current market risk state. The majority of the trading activity occurs in these periods. Finally, during the stable high risk periods, Risk Timing™ has determined the potential for a catastrophic drawdown event is at its highest and a portfolio would have its long exposure eliminated until risk was reduced enough to re-enter.